Pine Channel Project

Gold | Silver | Polymetallic | Saskatchewan, Canada

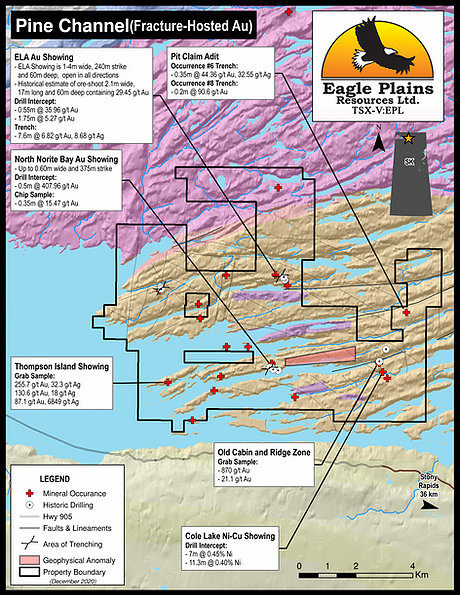

The 6,308 hectare Pine Channel Property is located 43 km west of Stoney Rapids, Saskatchewan. Highly prospective for fracture-hosted gold, the property contains 17 mineral occurrences and has not been explored since 1988. Reports compiled near and after exploration ceased, provide a solid geological model for future programs. The project is bisected by a hydropower line.

Acquired in early 2019 by Eagle Plains Resources, Apogee has the right to earn in 80% of the project.

Project Highlights

- Has not been explored since 1988

- Multiple encounters of bonanza-grade gold in drill intercepts

- Numerous mineralized gold occurrences

- Encouraging exploration to date with most drilling <100m

- Hydro powerline bisecting the property

2024 Completed Field and Geophysical Work

The recently completed 2024 exploration program included a 267-line kilometre, helicopter-borne, magnetic survey at 75m line spacing over areas of the property without detailed magnetic coverage and geologic mapping in the vicinity of the Algold Bay occurrence. Several structural trends important for Au have been identified, and ten new prospective trends have been located. Additional groundwork is recommended along several of the trends identified from the recently completed surveys at the Project.

Geology

The Pine Channel project lies within the Tantato Domain composed of highly deformed mylonitic gneisses forming the eastern margin of the Archean Rae Craton. The lithologies within the domain are predominantly supracrustal and appear to be derived from volcaniclastics manifest as felsic to mafelsic granulites and gneisses. The supracrustals of the Tantato Domain were later intruded by granitoid bodies.

Numerous gold occurrences have been discovered within the property boundary which is located along the SW portion of the Tantato structure. This area is host to a structurally lower sequence of mylonitic garnet-quartzofeldspathic gneisses and mylonitic garnet-clinopyroxene mafic gneisses. The garnet-quartzo-feldspathic gneisses are strongly differentiated between discontinuous quartz lenses alternating with feldspar layers. The garnet-clinopyroxene gneisses have variously been referred to as norites, and meta-basites that are most likely derived from extrusive and intrusive igneous rocks. These mafic gneisses are host to concordant zones of pyrrhotite and pyrite mineralization and locally are associated with graphitic schists. The rocks have been subject to polyphase metamorphism with the dominant foliation trending to the northeast and rocks typically dipping between 40°-60° to the southeast.

Mineral occurrences

There are 17 historical mineral occurrences on the Pine Channel Property, the majority of which are interpreted to host structurally-controlled mesothermal lode gold mineralization. Nickel and uranium are also present on the property and appear to be structurally controlled in polymetallic veins and intrusion-hosted magmatic.

Some of the more notable of these showings include:

ELA Au Showing:

The ELA Au showing is a quartz vein mineralized with arsenopyrite, pyrite, and minor chalcopyrite disseminations. The vein varies between 1-4m wide, a strike length of 240m and 60m deep, open on both ends and to depth. Drilling assays reported from 0.31 g/t Au over 0.7 m to 35.96 g/t Au over 0.55 m. A size estimate of an ore shoot within the vein system was released in 1952 and recalculated again 1982 suggesting a high-grade shoot of 36.6 m long, 1.2 m wide and 60 m deep with a grade of 15.81 g/t Au. The 1982 estimate calculated it to be 17.0 m long and 2.1 m wide with an uncut grade of 29.45 g/t Au. Later work traced the vein for 240 m and in 1987, 12 NQ drill holes traced the mineralized vein to 38m deep, highlights from these programs include:

| Sample Type | Results | Description of Zone and Sampling |

|---|---|---|

| Drill Intercept | 0.55m @ 35.96 g/t Au | ELA Au Showing, 1-4m wide, 240m strike length and 60m deep. Open on strike in both directions and to depth. Historic estimate of an ore-shoot at 2.1m wide, 17m length and 60m depth containing 29.45 g/t Au. |

| Drill Intercept | 0.52m @ 45.26 g/t Au | |

| Drill Intercept | 1.75m @ 5.27 g/t Au | |

| Trench | 7.6m @6.82 g/t Au, 8.68 g/t Ag | |

| Trench | 3.0m @ 24.52 g/t Au |

PIT Claim Adit - Occurrences #6 and #8

These showings collectively known as the PIT Claim Adit are located 150m to 200m apart. Occurrence #6 Au consists of 5 veins. Veins 1-3 host hosting tourmaline, arsenopyrite and pyrite mineralization while veins 4 & 5 host to considerable arsenopyrite, minor pyrite and may or may not contain quartz. Located to the west, Occurrence #8 Au is a 60m long 0.03-0.3 m wide quartz vein hosted within garnet-quartz-feldspar paragneiss. The vein is mineralized with arsenopyrite and rare specks of native copper.

| Sample Type | Results | Description of Zone and Sampling |

|---|---|---|

| Trench | 0.35m @ 44.36 g/t Au and 32.55 g/t Ag | Occurrence #6 West |

| Trench | 0.2m @ 5.18 g/t Au and 0.45m @ 3.78 g/t Au | Occurrence #6 East Vein |

| Trench | 0.2m @ 90.6 g/t Au | Occurrence #8 |

| Trench | 0.3m @ 3.32 g/t Au and 0.71 g/t Ag | Occurrence #8 |

Cole Lake Ni-Cu Occurrence

The Cole Lake Occurrence is a nickeliferous pyrrhotite zone occurring within a 12.1m wide norite body. The norite body is underlain by paragneisses and has been traced for 183m on strike. Pyrrhotite is disseminated throughout the norite and also concentrated in a ~1.0 m wide gossanous fractured central portion of the norite. Four drill holes and chip sampling from trenches were conducted with the following highlights:

| Sample Type | Results | Description of Zone and Sampling |

|---|---|---|

| Drill intercept | 0.45% Ni over 7.0 m | Cole Lake Ni-Cu - drill hole #1 |

| Drill intercept | 0.40% Ni over 11.3 m | Cole Lake Ni-Cu - drill hole #2 |

| Drill intercept | 0.65% Ni over 4.6 m | Cole Lake Ni-Cu - drill hole #4 |

| Trench | 0.97% Ni and 0.13% Cu over 2.3 m | Cole Lake Ni-Cu |

North Norite Bay Au Showing

This showing is a quartz filled shear zone with veins up to 0.6 m wide and traced over a strike length of 375m in biotite-quartz-feldspar gneiss. The quartz veins and surrounding sheared host rocks contain up to 10% combined pyrite an arsenopyrite. Twelve AX drill holes and chip sampling were completed to test the mineralized shear zone, highlights include:

| Sample Type | Results | Description of Zone and Sampling |

|---|---|---|

| Drill intercept | 0.5m @ 407.96 g/t Au | Drill hole 11 – AX size |

| Drill intercept | 0.33m of 4.71 g/t Au | Drill hole 05 – AX size |

| Chip | 15.47 g/t Au over 0.35 m | Quartz Vein |

| Chip | 57.91 g/t Au over 0.2 m | Quartz Vein |

Occurrence #9 Showing (Main Vein, Rob Au Showing and AC Au Vein)

The Occurrence No. 9 Au Showing includes three gold-bearing quartz veins (Main Vein, Rob Au Showing and AC Au Vein) hosted within metamorphosed intrusive rocks. The Main Vein is a 200 m long, 0.1-2.5 m wide north-south striking vertical vein that crosscuts the quartz-pyrite-arsenopyrite AC and Rob Veins. Quartz vein-hosted mineralization consists of veinlets and lenses of arsenopyrite, pyrite, pyrrhotite, and minor chalcopyrite with gold generally associated with semi-massive arsenopyrite mineralization.

| Sample Type | Results | Description of Zone and Sampling |

|---|---|---|

| Drill intercept | 0.53 g/t Au over 0.5 m | Main Vein – AX size drill |

| Drill intercept | 0.37 g/t Au over 0.5 | AC Zone – AX size drill |

| Chip | 4.3 g/t Au over 2.0 m | Main Vein |

| Grab | 14.88 g/t Au and 13.64 g/t Ag | Main Vein |

History

In the Pine Channel area, reconnaissance geology in the form of government reviews and mapping programs began in the late 1950’s. Several additional reports on uranium deposits and gold occurrences were carried out being carried out into modern times. In the late 80’s geological mapping at the 250k scale had been completed over the area. Additional government datasets include 3 airborne geophysical surveys and GSC lake sediment geochemistry.

Industry exploration of the area began in 1950 and a total of 41 work programs have been conducted within the property. These include 20 drill holes, prospecting, trenching, mapping and geophysics by Goldfields Uranium Mines from 1950-1952. Between 1955 and 1988 the property has been investigated by a number of companies including but not limited to Cominco, Denison, SMDC, Colchis Resources, Minatco, Inexco, Varmac Uranium and Western Mines. These companies preformed 36 programs on the property including 106 holes over 11 drill programs, 17 geophysical surveys of various types and size, trenching, geologic mapping, prospecting, soil and rock sampling, biogeochemical and sediment sampling.

The last exploration program to be carried out on the property was in 1988 and the majority of the drilling to that point was completed using small diameter (AX) core. This small core is poorly suited to sampling the high grade, nuggety gold mineralization present in the Pine Channel area and that the historically low gold grades that drilling returned relative to gold grades observed at surface are likely not accurate. In addition to this, most of the drilling on the property has been relatively shallow (~<100 m) and the potential to test for further continuity at depth is considered to be excellent.

Eagle Plains Exploration

A review of all available data was conducted in 2018 concluding that there are three styles of mineralization on the property: vein hosted uranium, pyrrhotiferous Ni-Cu mineralization hosted within norite bodies, and fracture hosted gold mineralization. The fracture hosted gold mineralization is the most likely to be present in quantities of economic significances and is the focus of exploration activities.

In 2019 Eagle Plains completed a limited field program to evaluate and confirm the nature of mineralization previously documented at historical showings. During this program rock samples were collected from various known occurrences and returned values ranging from 7 ppb Au up to a maximum of 77.5 g/t (2.73 oz/T) Au.

Earn-In Option Agreement

Pursuant to the terms of the Option Agreement, upon and subject to receipt of Exchange acceptance for Apogee Minerals Ltd.'s (formerly TCAP) Qualifying Transaction, Apogee will have the right to acquire an 80% interest in the Pine Channel Property by:

- paying to EPL an aggregate of CDN $100,000 in cash according to the following schedule:

- $25,000 on the Effective Date (date of execution of the formal agreement);

- an additional $25,000 in cash on or before December 31st, 2021;

- an additional $50,000 in cash on or before December 31st, 2025;

- issuing to EPL an aggregate of 2,100,000 Shares, according to the following schedule:

- 200,000 Shares on the completion of the qualifying transaction;

- an additional 300,000 Shares on or before December 31st, 2021;

- an additional 300,000 Shares on or before December 31st, 2022;

- an additional 500,000 Shares on or before December 31st, 2023;

- an additional 700,000 Shares on or before December 31st, 2025; and

-

$100,000 additional shares as consideration for latest amendment (June 2025)

- incurring aggregate Exploration Expenditures on the property of:

- $100,000 on or before June 30th, 2022;

- an additional $500,000 on or before June 30th, 2023;

- an additional $500,000 on or before December 31st 2025; and

- an additional $2,000,000 on or before December 31st, 2025.

Upon the exercise of the Option and the acquisition of an 80% interest in the Pine Channel Property by Apogee, the Optionor will retain a 2.0% net smelter returns royalty on the Pine Channel Property, and 1.0% of the net smelter returns royalty may be purchased by Apogee at any time for CDN$1,000,000. Apogee will be Operator of the project throughout the term of the option.

Charles C. Downie, P.Geo., a “qualified person” for the purposes of National Instrument 43-101 - Standards of Disclosure for Mineral Projects and a Director of Eagle Plains Resources Ltd., has prepared, reviewed, and approved the scientific and technical disclosure in this webpage.